Workshop on the quality of loan applications organized by PfD Benin and MFI Partner, FECECAM

Credit Program Officer, Ferdinand Dahoueto is addressing participants questions on the quality of loan application. Abomey-Calavi, April 2023. Credit: Epiphane Adjadji, PfD.

Based on the observation that many micro, small and medium-sized enterprises struggle to pass the application review stage with microfinance institutions, PfD initiated this information and awareness session led by FECECAM on the content of a loan application file. Participants were given a detailed explanation of the various components of the file to be submitted, the different types of guarantees, the facilitation of the National Agricultural Development Fund (FNDA), the importance of the professional card and the need to organize themselves into a formal company.

PfD gives the greatest importance to the role of partners in every aspect of our work. We are deeply committed to involving local counterparts in assessing needs, designing programs, implementing activities and learning from the communities we jointly serve. PfD’s partner-oriented approach directs us to work with and harness the resources of the international community to meet the needs of vulnerable populations. Therefore, during our December campaign we wanted to feature one of our partners. Below is a Q&A with Pastor Ayuba Musa from Gerawa Women Multi-purpose Cooperative Society from Bauchi state, Nigeria.

PfD gives the greatest importance to the role of partners in every aspect of our work. We are deeply committed to involving local counterparts in assessing needs, designing programs, implementing activities and learning from the communities we jointly serve. PfD’s partner-oriented approach directs us to work with and harness the resources of the international community to meet the needs of vulnerable populations. Therefore, during our December campaign we wanted to feature one of our partners. Below is a Q&A with Pastor Ayuba Musa from Gerawa Women Multi-purpose Cooperative Society from Bauchi state, Nigeria.

Q: How did you first learn about PfD?

A: Gerawa Women Multi-purpose Cooperative Society is a community based rural micro-finance organization, base in Bauchi, Bauchi State of Nigeria. The organization got to know about Partners for Development in 2004. Prior to this time, Gerawa has been engaging in micro-credit program in the State at an elementary or infant stage. The institutional capacity of the organization to operate effectively and efficiently and the knowledge on micro-credit standard best practice was low. The capacity of the organization to access loan to finance its clients was low, with low portfolio strength of USD $15,000, out of which 80% of the loans were in arrears. It was at this stage that the organization team up with PfD.

Q: What led you to work with PfD?

A: Gerawa was so fascinated with PfD’s programs in Bauchi state which cut across (a) rural infrastructure development (b) small enterprise development i.e. micro-credit (c) health i.e. Reproductive health (d) and institutional capacity development/building. Taking the capacity challenge of the organization into consideration, Gerawa requested support with the micro-credit program in order to meet the need of our clients and reduce poverty level among the rural and vulnerable household women in the State.

Q: Tell us about the growth of your organization?

A: After over 10 years of good partnership with PfD, Gerawa has grown from lending USD $12,000 to $112,000 per year. Apart from micro-financing, the organization has equally benefited from the following PfD project activities:

Reproductive health training and support

- Integrated health and microfinance programming

- Expanded access to services for agricultural enterprise

- Business development skill training

- Nigeria Agricultural Enterprise Curriculum (NAEC) training and support

All these projects targeted rural women to improve their skills, increase sales and improved income. The uniqueness of implementing PfD project in the communities is integration approach to project delivery, which allows beneficiaries to access and enjoy more than one intervention at a time – holistic development.

Q: How has this partnership impacted your work?

A: The impact of the project implemented with PfD over years resulted in:

Improved Micro-finance: To date, we have issued over 3,200 microcredit loans mainly to women – 95% of borrowers are women.

Institutional capacity development of the organization: At the start of the project with PfD, an operational grant of over a million naira was received from PfD to complement staff salary and other administrative overheads. Likewise, trainings, seminars and workshops were organized by PfD to build the capacity of the implementing staff of the organization in project delivery and methodology so that we could sustain the work after the completion of the grant.

Supporting women farmers: We were able to strengthen the capacity of more than 2,000 small agricultural business holders, who were mainly women, to effectively plan, save, record, forecast, and negotiate properly for their products.

Successful program integration of health and microfinance: A total of 48 communities were reached and 2,747 women borrowers received health training and information, 11,420 immunization were given, 980 women of reproductive age received family planning commodities, 3,620 attended anti-natal care and 122 received various counseling on RH related issues.

Q: Any closing thoughts?

A: In conclusion, PfD has done great things in transforming the lives of ordinary people for the better, but there is still more to be done, thousands and millions of unreached ones are still plaguing in abject poverty and dying daily. PfD still needs more support to be able to continue doing the good work and be able to reach the less privileged.

Throughout all of December we will be sharing stories from our staff, board, partners, and others from around the globe. We can’t wait to share all of the hopeful, engaging, and positive stories from our work. We will be using the hashtag #IamPfD on Facebook, Twitter and LinkedIn.

Be sure to share the posts that you find engaging and inspiring with friends and family and don’t forget to donate and take an #unselfie of you making a donation and share it with us and use the #IamPfD for a chance to win prizes from PfD.

“Thanks to the GREEN Project, I sell lots of really good vegetables,” says Bonaventure Odoubiyi, a farmer near the city of Allada whose high quality vegetables have earned him the exclusive clientele of a prestigious hotel in the area. Before his introduction to Project GREEN (GREEN blog post), Bonaventure was a typical vegetable farmer in Benin who grew only local vegetables and followed traditional cultivation methods by using large amounts of cheap, ineffective fertilizer, overcrowding his small plots, and relying exclusively on rain for irrigation. With little bargaining power, Bonaventure sold his produce at the nearest market to whomever he could at whatever price, earning only around 30,000 CFA ($60) a month.

Wanting to develop his business, Bonaventure began attending GREEN trainings, where he learned how to improve the quality of his vegetables and increase crop yields. Through GREEN’s market and business management training, Bonaventure learned about market-driven crop production and how to approach local markets when looking for new clients, leading him to discover the Royal Palace Hotel, an upscale French-owned resort just outside the small city of Allada. To provide for the hotel, Bonaventure began to grow vegetables such as eggplant, radishes and beets, which are not sold on the local market but have a strong clientele with foreign restaurants and hotels like the Royal Palace that tend to pay more for higher quality produce.

Bonaventure engaged the finance and business skills he learned from GREEN to successfully apply for a small loan of $1,000 (500,000 FCFA) from the Federation of Savings and Loans Institution, GREEN’s micro-finance partner. After purchasing a nearby field, he bought a motorized pump to irrigate his crops, and his hard work and investment began to pay off as he saw an improvement in the quantity and quality of his produce. Bonaventure then decided to bring samples of his new crops to the Royal Palace Hotel. Impressed with the quality and variety of his selection, the hotel immediately purchased all of his produce and even offered Bonaventure a contract to continuously supply them with his vegetables.

Bonaventure’s business with the hotel grew rapidly, but despite his larger and more productive fields, he still could not meet the demands of the Royal Palace. Consequently, Bonaventure reached out to other GREEN-trained vegetable growers to help him meet the demand. Now, Bonaventure is a farmer, as well as the head of a vegetable supply business. His own crops supply about 30% of the Royal Palace Hotel vegetables, while the rest comes from his network of GREEN farmers. The hotel has been so impressed with the quality of Bonaventure’s weekly deliveries that over the past year they’ve recommended Bonaventure’s produce to another upscale hotel that also offered him a contract for his vegetables.

Bonaventure is proud of his accomplishments, new business and increased income. Thanks to GREEN’s support and training, he now makes nearly $300 USD (150,000 FCFA) each month, five times more than he used to earn. Every time he adds clients to expand his business, he contracts GREEN-trained farmers to help meet the demand. Bonaventure is becoming a successful entrepreneur, and he credits part of his achievement to all of the help and support from the GREEN Project.

With around 70% of Benin’s population dependent on income generated through agriculture and livestock production, and with 35.2% of the population living in poverty, increasing productivity and incomes in the agriculture sector is essential to improving livelihoods in Benin. Farmers in Benin, however, face many challenges including an inadequate supply of inputs such as fertilizers, post-harvest losses of 25% or more, limited market information, and little to no access to credit (USDA GAIN Benin, 2014).

To support Beninese farmers to address these problems, the USDA-funded Growing Resources for Enhanced Agricultural Enterprises and Nutrition (GREEN) Project helps smallholder vegetable farmers improve and increase crop production and expand the sale of their produce. The GREEN Project works directly with local farmers’ associations and organizations and individual farmers, providing them with the training and tools necessary to train farmers to overcome obstacles through improvements in cultivation techniques, increase understanding of value chains and market-driven production, and improve post-harvest management and business skills.

Tell me and I’ll forget; show me and I may remember; involve me and I’ll understand. –Proverb

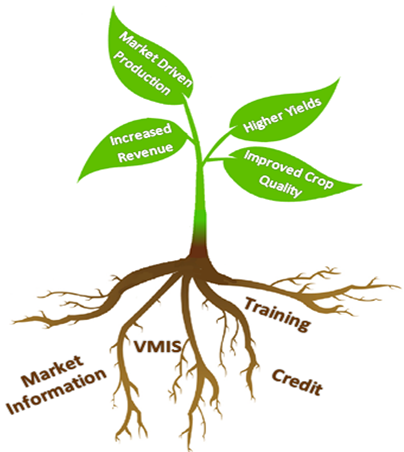

As shown in the diagram above, the GREEN Model involves four major activities: 1. Hands-on, field-based training; 2. Access to credit; 3.Market information and access; and 4. Vegetable Market Information System (VMIS). Combined, these interventions have led to market driven production, increased revenue, higher yields, and improved crop quality.

Training: Our approach: learning by doing. PFD provides local organizations with resources, knowledge, and training on business, marketing, the value chain and new farming techniques. In turn, these organizations, with their newly acquired knowledge, deliver interactive trainings in the field, giving the farmers the opportunities for hands-on learning. This way, the capacity of local organizations is strengthened as well as the capacity of individual farmers. Through this approach, the GREEN Project has trained over 11,000 farmers in improved cultivation technologies and over 4,000 farmers in post-harvest technologies and value chain approaches.

For instance, working with the Agriculture and Food Technology Program, PFD held a week-long hands-on training focused on food processing and preserving. Processing food allows for farmers to sell their products throughout the year, increasing food security. Take tomatoes for example: by transforming part of their tomato crop into tomato purée, farmers are able to stock-up for the off-season when products become expensive and most families are unable to buy the vegetables needed for basic nutrition.

For instance, working with the Agriculture and Food Technology Program, PFD held a week-long hands-on training focused on food processing and preserving. Processing food allows for farmers to sell their products throughout the year, increasing food security. Take tomatoes for example: by transforming part of their tomato crop into tomato purée, farmers are able to stock-up for the off-season when products become expensive and most families are unable to buy the vegetables needed for basic nutrition.

Market Access & Information: GREEN promotes farming decisions based on real-time information. In Benin, many farmers are solely focused on their crops and therefore do not fully understand the value chain. Some farmers have never visited the marketplace where their products sold and crop selection is based on what their family has planted for generations. GREEN’s trainings on the markets and value chain involve trips to the markets to analyze the demand and supply of different vegetables and produce. By actively engaging the farmers in these trainings, PFD and its partners help farmers understand the consumer demands, diversify their crops, expand their markets and ultimately, raise their incomes. For instance, working with the Agriculture and Food Technology Program, PFD held a week-long hands-on training focused on food processing and preserving. Processing food allows for farmers to sell their products throughout the year, increasing food security. Take tomatoes for example: by transforming part of their tomato crop into tomato purée, farmers are able to stock-up for the off-season when products become expensive and most families are unable to buy the vegetables needed for basic nutrition.

PFD, in collaboration with ESOKO a Ghanaian firm, developed a specific vegetable market information system (VMIS) that sends real-time SMS messages of local market prices to farmers, processors, wholesale buyers and sellers. While working in their fields, farmers can access the daily information and better negotiate the prices for their crops. PFD’s VMIS, recently featured at the Agri-Hub Benin Agricultural Finance Fair sponsored by SNV-Benin, registered hundreds of new users.

Access to Credit: The GREEN Project expands access to credit to farmers. GREEN partners with local Beninese banks and microfinance institutions and builds their capacity to loan to smallholder farmers. Vegetable Producers Without Bordersfaced real challenges when they began planting in 2009: from insufficient technology such as irrigation systems to an ongoing struggle to find good markets. Enter GREEN. PFD trained the group on how to develop detailed business plans allowing them to access credit which allowed the farmers to increased cultivation from ¼ hectare to two hectares and diversify their crops. Vegetable Producers Without Borders are now on their second loan and have installed an irrigation system allowing them to produce higher quality crops and expand their market to new Beninese towns and even into Nigeria.

By building capacity of both local organizations and individual farmers and by intensively involving farmers in trainings, PFD continues to plant seeds for sustainable and lasting growth in Benin. Through GREEN Project trainings, 96% trainees adopted the improved cultivations methods taught. Targeted farmers’ income also increased, with an over 220% increase in net sales revenue from their vegetables.

Find out more about PFD’s work in Benin and in agriculture.

Partners for Development is in its 14th year helping to provide those in need access to credit in Nigeria. PFD currently builds the capacity and provides loans to over 20 local microfinance banks and institutions. Increasing access to credit for impoverished peoples is a proven and successful way to help people break the cycle of poverty. By providing small loans to individuals who are denied traditional loans by banks and commercial loan agencies, PFD provides them with the means to start a business, invest in more and better food resources, pay for school fees, and afford healthcare. From 2001 to 2013, PFD directly issued over $ 2.6 million USD in loans to over 76,128 borrowers in Nigeria. However, our reach is multiplied as local partners have been able to relend funds several times. Over 95 percent of the loans are provided to women.

But, why focus on lending to women?

In Nigeria, especially in rural areas, women are in the background and many do not have a large voice in their communities. The Honorable Hajia Zainab Maina, Minster of Women Affairs and Social Development for Nigeria remarked that although “women constitute about 50 percent of the national population” and “contribute about 60 percent of local food production… their role in promoting economic and social change continues to be inadequately recognized and undervalued.” Further, a 2012 report on gender equality in Nigeria (UKAID) found that women often lack access to credit and are unable to participate in the formal economy. Thus providing credit for women brings them closer to financial inclusion and allows them to flourish as entrepreneurs. Furthermore, by participating in microfinance, women are empowered and able to increase their self-reliance. With their increased confidence gained through expanding their businesses and increasing their family income, women are able to play a larger role both within the home – i.e. planning the family budget – and in their communities.

In Nigeria, PFD and our local partners loan to women because they are best able to prioritize the family’s needs, focusing on family health, nutrition, and education.

Not only does the access to credit allow women to start or expand businesses, but PFD and our partners are multiplying the benefits gained by our entrepreneurial women by incorporating health messaging into the loan process. PFD uses the microfinance process as a platform to hinge other programing and projects such as reproductive health and exclusive breast feeding. When the women attend their regular weekly or monthly microfinance group meetings, they also receive information on breastfeeding practices, reproductive health, personal hygiene and nutrition; by incorporating messaging we are building on a platform which already exists and the women trust the messaging because of the known source.

The aforementioned integrated program was studied by researchers from the UNC Gillings School of Global Public Health and the results were published in the Journal of Nutrition who found that women who participated in the microfinance programs with the health messaging had an increased likelihood of exclusively breastfeeding their infant for the first six months. Additionally, the study found that the women who participated were less likely to give their baby water instead of breast milk. These changes can have drastic effects on reducing illnesses and death for infants in their first years. Children who are breastfed have at least a six times greater chance of survival in the first few months than non-breastfed children and using optimal breastfeeding practices would prevent more than 800,000 deaths of children under five (UNICEF, 2014).

The aforementioned integrated program was studied by researchers from the UNC Gillings School of Global Public Health and the results were published in the Journal of Nutrition who found that women who participated in the microfinance programs with the health messaging had an increased likelihood of exclusively breastfeeding their infant for the first six months. Additionally, the study found that the women who participated were less likely to give their baby water instead of breast milk. These changes can have drastic effects on reducing illnesses and death for infants in their first years. Children who are breastfed have at least a six times greater chance of survival in the first few months than non-breastfed children and using optimal breastfeeding practices would prevent more than 800,000 deaths of children under five (UNICEF, 2014).

The women involved in the program gain knowledge and are empowered to share the new information with their community. For instance, one participant who attended the additional health trainings with one of PFD’s partners said “[the classes] really added to my knowledge and [have] given me the boldness to face my daughter and other women around me to enlighten them on some health issues.”

More recently, PFD has integrated of business and financial skills training within the microfinance program, in which borrowers with minimal levels of education are trained using an experiential learning curriculum jointly developed by PFD and other development partners in Nigeria. PFD’s microfinance programs also help the next generation, since many women use the money they earn first and foremost to pay for education costs for their children. PFD and our partners are offeringscholarships so that those involved in the program are reinvesting the money into their small business to encourage growth and improved livelihoods. Through the Anne Johnson Memorial Scholarship Fund in memory of Anne Johnson, who served as the Country Director for Nigeria and dedicated 20 years to work with PFD, and our partners, we award educational scholarships to girls of microfinance borrowers.

Since 2001, PFD has expanded and manages microfinance activities in five other countries: Bosnia & Herzegovina, Liberia, Cambodia, Tanzania, and Benin.

Keep up to date with PFD by following us on Facebook and Twitter!

Throughout all of December we will be sharing stories from our staff, board, partners, and others from around the globe. We can’t wait to share all of the hopeful, engaging, and positive stories from our work. We will be using the hashtag #IamPfD on Facebook, Twitter and LinkedIn.

Donate Now

Be sure to share the posts that you find engaging and inspiring with friends and family and don’t forget to donate and take an #unselfie of you making a donation and share it with us and use the #IamPfD for a chance to win prizes from PfD.

The CDC reports that improved water, sanitation and hygiene could potentially prevent 9.1% of the global disease and 6.3% of all deaths. Therefore, PFD and UNICEF –are teaming up in Nigeria to Strengthening Capacity of Local Institutions to Drive Community-Centered WASH Service Delivery. The project will help improve access to safe drinking water and improve sanitation facilities in three southern states of Nigeria.

Less than 20 % of households in the three PFD target areas are using improved water sources and less than half of households in these areas have improved sanitation facilities (Nigerian Ministry of Health). Drawing from past experience working in Nigeria and implementing WASH programming in Cambodia, PFD will work with local organizations to empower communities through trainings and other tools to create sustainable improvements providing

Less than 20 % of households in the three PFD target areas are using improved water sources and less than half of households in these areas have improved sanitation facilities (Nigerian Ministry of Health). Drawing from past experience working in Nigeria and implementing WASH programming in Cambodia, PFD will work with local organizations to empower communities through trainings and other tools to create sustainable improvements providing

water, sanitation and hygiene (WASH) services.

Key to PFD efforts are two things: sustainability and integration.

Building a strong foundation is vital to sustainability. The foundation for this program: Community Water, Sanitation and Hygiene Committees (WASHCOM). PFD will work within local communities of six Local Government Areas (LGA) each in Delta, Edo, and Ekiti states to organize and empower 600 WASHCOMs through training, mentoring, and other methods. The training of trainers is a key part of building capacity to ensure sustainability. State level workshops will train project staffs and volunteers to facilitate the project interventions in their communities and continuous mentoring of trainees will allow for the internalization of their new skills. Additionally, by creating a forum in each community, community members will have a space to share and learn best practices for the implementation of WASH activities. The forums will also provide a foundation so each community can continue to address WASH problems and adapt to changing needs in the future.

Going forward, WASHCOMs will serve as a platform for integrated programing. With a community structure in place, PFD and UNICEF will be able to address different community needs, providing reproductive health and family planning messaging, a platform for community peacebuilding and social bonding, and trainings for facilitation.

We know that integrated programming works: PFD’s programs done in unison have proven to be far more successful together than they are alone. When PFD integrated breastfeeding and maternal health messaging into its microfinance program in Nigeria, researchers found the number of women who exclusively breastfeed their infants increased.

The key to these successful sanitation interventions is not just the visible infrastructure, but also the corresponding education and community awareness. Working in the isolated and underserved northeast region of Cambodia, PFD improved rural access to safe water and sanitation in a country where less than 30 percent of the rural population has access to safe water and less than 10 percent to adequate sanitation.

Essential to this process is working with and through local organizations – PFD’s modus operandi. By strengthening the capacity of local organizations and equipping local CBOs to manage the work it both increases the level of community participation and provides a foundation for local ownership. Within the water and sanitation programs in Cambodia, PFD integrated health, nutrition, and food security activities, recognizing the interconnected nature of development and the need a multifaceted approach.

Follow the links to learn more about PFD‘s programs in WASH and health, and our work inCambodia and Nigeria!

Originally published on DevEx through the Healthy Means Campaign

By: Dr. Valerie Flax

In resource-constrained settings, early and exclusive breastfeeding prevents infant and child deaths from diarrhea and other infectious diseases, supports normal growth, and improves cognitive performance throughout childhood. Yet, optimal breastfeeding practices are declining globally, with less than half of the world’s newborns benefitting from early breastfeeding and about one-third exclusively breastfed for the first six months of life. Low-cost and effective strategies to improve breastfeeding behaviors in underserved areas are urgently needed.

Photo 1: A credit officer leads a discussion on breastfeeding during a monthly microcredit meeting in Bauchi State, Nigeria

how to download norton antivirus on windows 8 on 8 using complete setup guide

Two ways to efficiently reach out to a large number of women with messages on breastfeeding are through microfinance programs and cell phone messages. Incorporating health programs into microfinance takes advantage of the social networks and social support inherent in group activities and that type of support is needed to change breastfeeding behaviors. Cell phone messages are a great way to increase the number of repeated contacts with women who most need encouragement to breastfeed. Partners for Development and researchers from the University of North Carolina tested these ideas in northeast Nigeria by integrating group breastfeeding promotion and cellphone messaging into a microcredit program. The integrated program increased the number of women who started breastfeeding early and who exclusively breastfed their infants for six months.

We reached out to women participating in a microcredit program, a system in which small business owners, often women, receive loans to begin or advance their enterprise. Small groups of five to seven friends, neighbors and/or relatives join the program together and meet regularly with several other small groups to repay their microloans.

Every month, credit officers led discussions about breastfeeding during microcredit meetings. Sessions covered recommendations for early and exclusive breastfeeding, benefits of following breastfeeding recommendations, breastfeeding techniques and timing for introducing complementary foods. Key messages from the meetings were sent as text and voice messages to phones that were given to small-group leaders, who were instructed to share the messages. Group members selected some messages to be dramatized or turned into songs and performed at monthly microcredit meetings.

Giving phones to small groups of women was a key component of the program. It pushed them to gather together to review and discuss the messages. Many groups also shared the messages with other community members, thereby facilitating a shift in social norms related to breastfeeding practices. One phone holder explained her experiences, “This is a trust given to me that when a message comes to the phone, I must try my best to share it with women in the group. I don’t only share with members of the group, but include neighbors. Even during casual discussions, as we pass time, I find a way to chip in something about our program to attract them. This way they have accepted the messages I share that come through the phone.”

By building innovative face-to-face and mobile health components onto a microcredit program, we can spread messages to women in the groups and their friends and neighbors, greatly broadening the impact. The intervention could be scaled up in Nigeria and adopted more widely given that nearly 200 million women, many of childbearing age, are involved in microfinance globally. Assuming that each woman participating can have an impact on 5 of her family members and friends, this type of program, if scaled up, has the potential to benefit 1 billion worldwide.

Author Valerie L. Flax, PhD, Assistant Professor of Nutrition in the UNC Gillings School of Global Public Health, led the study through the Partners for Development with funding from the Alive and Thrive small grants program. The study involved women from communities in the Bauchi State in northern Nigeria. This trial was registered at clinicaltrials.gov as NCT01352351. The Journal of Nutrition published the research in July 2014. Partners for Development is a non-profit organization with community-driven programs in Africa and Southeast Asia. PFD works with vulnerable populations in the areas of health, agriculture, food security, livelihoods, and microfinance.